Hello friends!

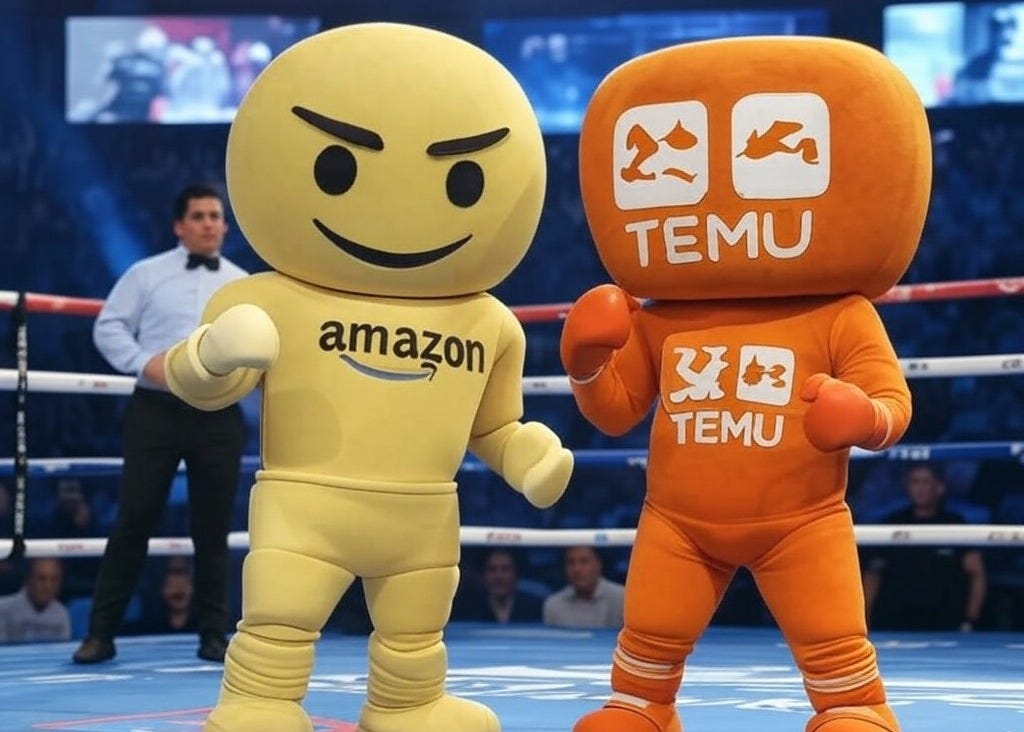

In its latest move to adapt to the shifting tides of e-commerce, Amazon has quietly rolled out Haul, a budget-focused section within its app that targets bargain-hunters who typically flock to competitors like Temu, Shein, and TikTok Shop. With ultra-low prices and a distinctive shopping experience, Haul could reshape Amazon’s approach to online retail. However, this venture also raises important questions for current Amazon sellers and highlights potential vulnerabilities tied to global trade policies.

Let’s explore what Haul means for the e-commerce landscape and the challenges it faces in a rapidly evolving market.

What Is Haul?

Haul is Amazon’s response to the booming "ultra-low-priced e-commerce" segment, a market that has seen tremendous growth thanks to companies like Temu and Shein. Here are the key features of this new offering:

Ultra-Low Prices: Most items are priced under $10, with nothing exceeding $20.

Shipping Policies: Free shipping on orders over $25, but a $3.99 fee for smaller purchases. Returns are free for items above $3.

Unique Shopping Experience: Unlike Amazon’s main marketplace, Haul’s interface features bright animations, “Crazy Low” sections, and urgency-inducing icons (e.g., burning flames and rocket ships).

Beta Stage: Haul is still in its early stages but has already seen millions of unique visits since its November launch.

Amazon is taking this experiment seriously, and it plans to expand Haul’s inventory significantly in the coming months. The company is leveraging its existing relationships with Chinese suppliers to stock Haul without requiring new vendor partnerships, streamlining its entry into this low-cost retail segment.

Why Is Amazon Entering This Market?

The rise of ultra-budget platforms like Temu has disrupted the e-commerce landscape. Temu, for example, has become the second most-visited e-commerce site globally, thanks to its aggressive pricing, fast shipping, and savvy marketing (such as a $14 million Super Bowl ad that boosted app downloads by 45% overnight).

Amazon’s Haul represents an attempt to:

Recapture Market Share: By offering a centralized hub for low-cost goods, Amazon aims to lure back shoppers who’ve turned to Temu and Shein for their affordability.

Capitalize on Consumer Trends: Bargain hunting has become a dominant trend, and Amazon is positioning itself to meet this demand head-on.

Test New Business Models: Haul operates independently of Amazon’s primary platform, suggesting Amazon is open to experimenting with new retail strategies.

Potential Impact on Current Amazon Sellers

Haul’s arrival could have significant implications for existing Amazon sellers, particularly those who operate in low-price categories. Here’s how:

Increased Competition: Haul’s inventory heavily overlaps with low-cost goods already available on Amazon’s main site. Sellers may find it harder to compete as buyers gravitate toward Haul’s curated, price-focused experience.

Pressure to Lower Prices: With Haul offering rock-bottom prices, existing sellers may feel compelled to reduce their own prices, potentially squeezing already thin profit margins.

Reduced Visibility: Amazon’s focus on promoting Haul could draw attention away from smaller sellers on its main platform, particularly those without the resources to adapt to these changes.

Shipping and Return Policy Adjustments: Sellers might face pressure to align with Haul’s policies, such as free returns for items over $3, which could increase costs.

The Role of Global Trade Policies

Haul’s business model relies heavily on low-cost imports from China, leveraging the de minimis provision, which allows goods valued under $800 to enter the U.S. without customs duties. This loophole is critical for keeping prices low, as many Haul items are shipped directly from Chinese manufacturers.

However, this strategy faces potential risks:

Tariffs Under President Trump’s Proposed Policies: Incoming President Trump has pledged to increase tariffs on Chinese imports, which could significantly raise the cost of goods sold on Haul. These additional costs might be passed on to consumers, eroding the price advantage that Haul currently enjoys.

Scrutiny of the De Minimis Provision: Recent federal discussions about limiting or eliminating the de minimis provision could disrupt the flow of cheap imports, not just for Haul but for competitors like Temu and Shein. If implemented, these changes would force companies to rethink their pricing strategies and supply chains.

Supply Chain Challenges: Rising tensions between the U.S. and China could lead to stricter trade regulations, further complicating the import of low-cost goods.

For Amazon, these uncertainties may explain why Haul has been launched cautiously and remains in its beta phase. While the platform’s success could bolster Amazon’s position in the budget market, it’s clear that Haul’s future depends on factors far beyond Amazon’s control.

Finally…

Haul is a fascinating experiment by Amazon, one that underscores the growing importance of the ultra-low-priced e-commerce segment. While it offers consumers unprecedented access to cheap goods, it also introduces challenges for current Amazon sellers and faces significant risks from potential trade policy changes.

For sellers, staying competitive in this evolving landscape will require careful attention to pricing, inventory selection, and shipping efficiency. Meanwhile, consumers should keep an eye on how Haul’s development unfolds—and how it may shape the future of online shopping.

The coming months will be pivotal in determining whether Haul becomes a permanent fixture of Amazon’s empire or just another experiment that fades into obscurity.

Best,

Aftab Borka

P.S. Don’t forget to tell your friends about my newsletter!

Thanks